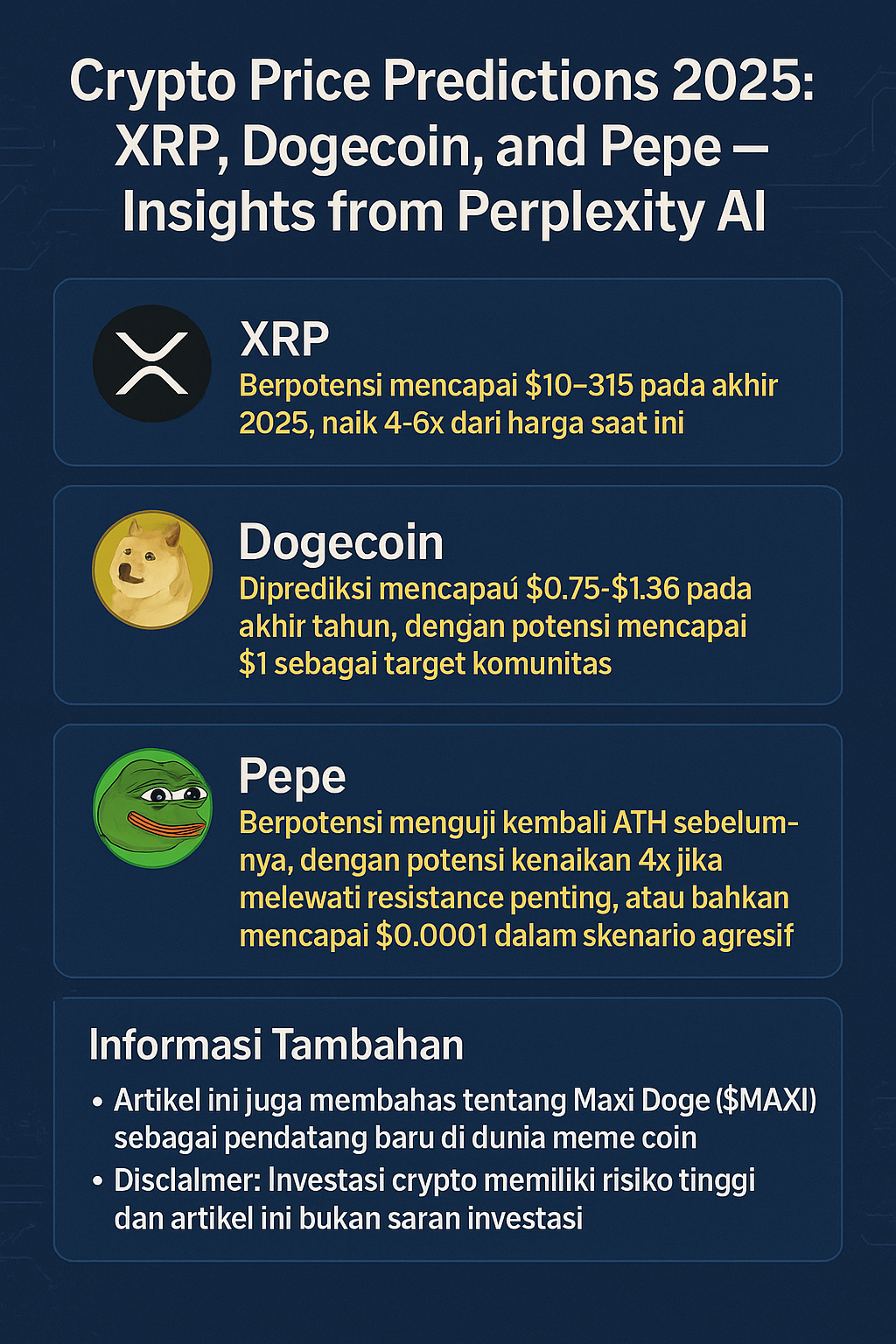

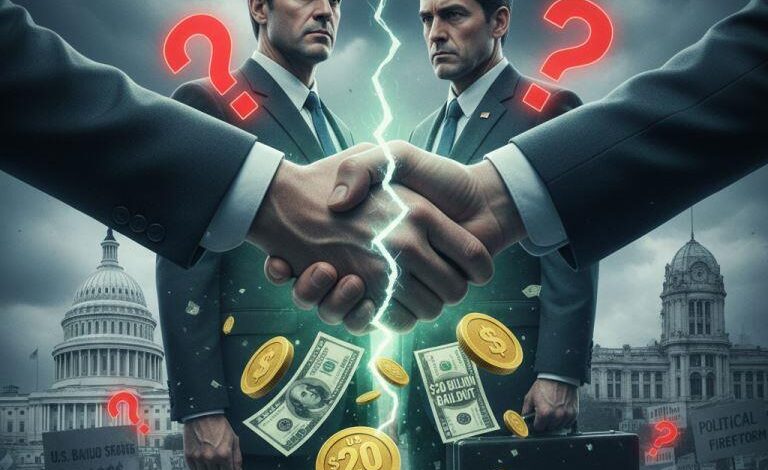

Why the U.S. $20 Billion Bailout to Argentina Sparks Political Controversy

Introduction: A Bailout with a Political Shadow

The recent $20 billion bailout granted by the United States to Argentina has ignited one of the most heated debates in international finance and politics this year. Supporters argue it’s a strategic move to stabilize Latin America’s fragile economy, while critics claim it’s a politically motivated decision disguised as economic support.

At the center of the storm stands Argentina’s President Javier Milei, a self-proclaimed libertarian and an open admirer of former U.S. President Donald Trump. His close ideological ties to the American right wing have fueled suspicions that this bailout is less about financial necessity and more about political alignment.

Background: The Fragile State of Argentina’s Economy

Argentina has long struggled with chronic inflation, debt defaults, and currency crises. The Argentine peso has lost over 90% of its value in the past five years, and the country’s foreign reserves have been depleted by repeated economic mismanagement and global market shocks.

In an attempt to restore confidence, President Javier Milei launched aggressive economic reforms — including deep spending cuts, deregulation, and a controversial proposal to “dollarize” Argentina’s economy.

These reforms, while applauded by international investors, have sparked domestic unrest due to rising unemployment and inflation rates nearing 200%.

Against this backdrop, the U.S. Treasury’s decision to approve a $20 billion bailout has been both a lifeline and a lightning rod.

The Mechanics of the Bailout: Currency Swap and Peso Purchase

The bailout was not a traditional loan through the International Monetary Fund (IMF). Instead, it involved a currency swap arrangement and direct U.S. government purchases of Argentine pesos, effectively injecting liquidity into Argentina’s financial system.

This unconventional structure allows Argentina to stabilize its exchange rate and rebuild foreign reserves, giving the Milei administration temporary relief from market pressure.

However, many economists and policymakers in Washington question the timing and transparency of this move — especially since it came during a period of U.S. government budget uncertainty and partial shutdown.

Political Context: Milei’s Trump Connection

To understand the controversy, one must look beyond the economic figures and into the political symbolism.

President Milei has repeatedly expressed admiration for Donald Trump, calling him a “defender of freedom against socialism.” Their shared populist rhetoric and nationalist views have created a strong ideological bridge between Buenos Aires and Trump’s political allies in Washington.

Critics argue that the bailout serves as a geopolitical favor, reinforcing the alliance between right-wing populist leaders rather than being rooted in traditional economic diplomacy.

The fact that some wealthy hedge fund managers — many of whom have deep ties to U.S. conservative circles — hold large stakes in Argentine bonds adds another layer of suspicion. By stabilizing Argentina’s currency, the bailout may indirectly benefit private investors more than the Argentine people.

Reactions from Washington and Wall Street

In Washington, the bailout has divided lawmakers.

Democratic legislators and fiscal conservatives alike question why American taxpayers should effectively subsidize a foreign government led by a politically aligned administration.

A senior congressional aide told Reuters,

“This is not a bailout — it’s a political gift. It benefits Trump’s allies abroad while Americans face budget cuts at home.”

Meanwhile, on Wall Street, the reaction has been more pragmatic. Markets welcomed the bailout as a sign that Argentina will remain solvent, at least in the short term. Argentine bonds saw a brief rally, and the peso strengthened slightly after the announcement.

But analysts caution that without structural economic improvements, the relief may be temporary.

Economic Rationale vs. Political Motivation

Supporters of the move insist that the bailout is a strategic investment in Latin American stability.

If Argentina’s economy collapses, it could trigger a chain reaction affecting neighboring countries and U.S. trade interests. Stabilizing one of South America’s largest economies could help protect U.S. financial exposure and prevent regional instability.

However, critics maintain that the optics are damaging. With the U.S. government facing its own fiscal challenges, committing billions abroad appears tone-deaf. Moreover, the lack of congressional approval and limited public transparency raise questions about accountability.

Economist Laura Sánchez of the University of Buenos Aires summarized the sentiment bluntly:

“This bailout may buy time, but it doesn’t buy trust. It looks more like political theater than economic policy.”

Implications for U.S.–Argentina Relations

In the short term, the bailout strengthens diplomatic ties between Washington and Buenos Aires. Milei, eager to attract foreign investment, will likely use the deal to signal Argentina’s renewed commitment to market-oriented reforms.

But the long-term consequences are uncertain. Future U.S. administrations could reassess or even reverse financial cooperation depending on shifting political winds.

If the bailout fails to deliver tangible benefits to ordinary Argentines, it could also fuel anti-American sentiment and undermine the very influence Washington seeks to build.

The Global Dimension: A Warning for Other Nations

The controversy surrounding this bailout sends a broader message to the developing world:

even large-scale financial aid can carry hidden political strings.

Emerging economies seeking Western support may find themselves caught between economic relief and political dependence.

As China and Russia continue to expand their financial influence in Latin America, U.S. moves like this one will be closely watched — and potentially mimicked — by rival powers.

Conclusion: Aid or Agenda?

The $20 billion U.S. bailout of Argentina may appear, on paper, as a move to stabilize a struggling ally. But beneath the surface, it reveals the complex interplay between economics, ideology, and global power dynamics.

Whether motivated by genuine financial pragmatism or political alignment, the decision underscores one reality:

In modern geopolitics, money is never just money. It’s influence, leverage, and sometimes — loyalty.

Final Thoughts and Recommendations

For policymakers:

Transparency is key. All international financial aid should come with clear conditions, public oversight, and accountability.

Separate politics from economics. Strategic assistance should be based on stability goals, not ideological alliances.

For investors:

Monitor currency risk — short-term gains from bailouts often fade once political momentum slows.

Diversify holdings in emerging markets and prepare for volatility driven by policy changes.

For Argentina’s leadership:

Use this financial breathing room wisely.

Prioritize domestic economic reforms, strengthen fiscal discipline, and rebuild public trust.

If handled carefully, this bailout could mark a turning point for Argentina.

If mishandled, it could become yet another chapter in the long story of politics undermining economic progress.