Bitcoin’s Year-to-Year Journey: A Relaxed, Research-Backed Deep Dive (2009–2025)

Bitcoin’s Year-to-Year Journey: A Relaxed, Research-Backed Deep Dive (2009–2025

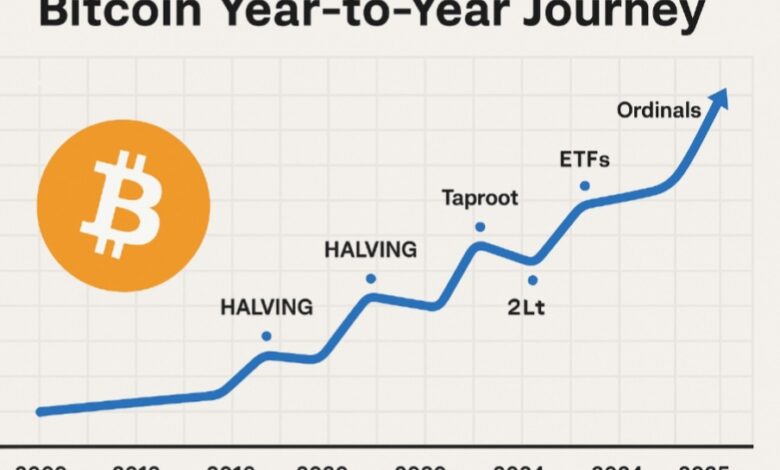

Updated: October 19, 2025 (Asia/Jakarta) — Bitcoin sits around the six-figure mark today, after a dramatic run that included fresh records in mid-2025 and sharp pullbacks this month. That volatility is the point: Bitcoin changes slowly on-chain, but its narrative evolves every year. Below is a friendly, research-driven tour of how we got here—and what the rhythms of each year can teach us. For context, Bitcoin’s protocol cuts new coin issuance roughly every four years (the “halving”), a supply shock that has historically shaped multi-year cycles. (charts.bitbo.io)

2009–2012: Invention, Bootstrapping, First Halving

Bitcoin launched in 2009 as peer-to-peer electronic cash. In the early years, prices were negligible, mining was a hobbyist pursuit, and exchanges were rudimentary. Crucially, the design encoded predictable monetary issuance that would halve block rewards from 50 BTC to 25 BTC after 210,000 blocks—an event that arrived in November 2012, setting a template for cycles to come. (charts.bitbo.io)

Why this era matters:

- Scarcity wasn’t just a meme; it was hard-coded issuance policy.

- Each halving compresses new supply, historically coinciding with rising multi-year demand.

2013–2016: Early Bubbles, Infrastructure, Second Halving

The first wave of exchanges, payment experiments, and VC interest arrived, alongside sudden rallies and deep drawdowns. The second halving in July 2016 reduced issuance to 12.5 BTC per block and occurred against a backdrop of growing global awareness. (Halvings occur about every four years; exact dates depend on block times.) (charts.bitbo.io)

What changed year by year:

- 2013–14: Wild price discovery and exchange growing pains.

- 2015: Builders quietly laid rails—custody, wallets, compliance.

- 2016: Halving focused attention on Bitcoin’s programmatic scarcity.

2017–2019: Retail Mania, Hangover, Building Season

2017 brought a retail-driven mania and the first true mainstream moment for Bitcoin. A brutal 2018–2019 bear market followed, but the ecosystem matured: regulated custody improved, derivatives launched, and institutions began writing investment theses. These quieter “build years” often determine how strong the next upcycle can be.

Signals to remember:

- Derivatives and custody deepened market structure.

- The “digital gold” narrative gained traction with macro investors.

2020–2021: Macro Tailwinds, Third Halving, Taproot

Bitcoin’s third halving landed in May 2020, slicing issuance to 6.25 BTC per block just as global liquidity surged. Macro uncertainty (pandemic stimulus, inflation fears) turbocharged the “store of value” thesis. In November 2021, Bitcoin activated Taproot, a major upgrade that improved privacy, efficiency, and smart-contract flexibility—quiet protocol progress during loud markets. (charts.bitbo.io)

Key takeaways:

- Halving + liquidity tailwinds fueled a powerful bull run.

- Taproot future-proofed the base layer for complex spending conditions.

2022–2023: Leverage Unwinds, Ordinals Spark a Cultural Shift

After the boom, 2022 exposed systemic leverage and risk management failures across lenders and exchanges. Yet 2023 surprised: Ordinals/inscriptions emerged, enabling non-fungible artifacts native to Bitcoin and igniting fresh debate about block space scarcity, miner fees, and Bitcoin’s cultural identity. (Galaxy)

Why it matters:

- Bitcoin isn’t static—new use cases can surface even on a conservative base layer.

- Fee markets evolved as inscriptions competed for block space.

2024: Spot ETFs & The Fourth Halving

January 2024 marked a watershed: the SEC approved 11 spot Bitcoin ETFs, unlocking simple, regulated exposure for institutions and retirement platforms. In April 2024, the fourth halving cut issuance to 3.125 BTC per block—again tightening new supply just as mainstream on-ramps expanded. (sec.gov)

What changed:

- ETF flows professionalized demand.

- Issuance dropped 50%—the slow heartbeat that often precedes multi-year supply-demand squeezes.

2025: New Highs, Sharp Pullbacks, Same Old Bitcoin

By mid-2025, Bitcoin printed fresh all-time highs above $120,000, before retracing sharply in October amid broader risk-off sentiment—reminding everyone that volatility is structural, not a bug. Today’s price action fits the historical pattern: post-halving bull cycles often include deep, sentiment-testing corrections on the way to new equilibria. (bytwork.com)

Patterns You Can Actually Use

- Four-Year Rhythm: Halvings (2012, 2016, 2020, 2024) cut supply; past cycles saw major advances within 12–24 months after each event. While not a guarantee, supply compression remains a durable framework. (charts.bitbo.io)

- Infrastructure → Liquidity → Price: Upgrades (e.g., Taproot), better custody, and new distribution (spot ETFs) historically precede the largest waves of adoption. (Coinbase)

- Narratives Rotate: Store-of-value, payments, “digital gold,” inscriptions—each era recruits new demand cohorts, each with different time horizons. (Galaxy)

- Volatility Is Endemic: Even near peaks, double-digit drops are normal; Bitcoin trades like a high-beta macro asset with a unique, programmatic supply curve. (Barron’s)

Year-by-Year “Movement” Cheatsheet (Narrative Lens)

- 2012: First halving. The market internalizes scarcity for the first time. (charts.bitbo.io)

- 2013–2014: Breakout + first big bust; exchange risk dominates.

- 2015–2016: Quiet build; second halving catalyzes next cycle. (charts.bitbo.io)

- 2017: Retail mania; Bitcoin becomes dinner-table talk.

- 2018–2019: Drawdown; professional rails get built.

- 2020: Third halving + liquidity wave; institutions notice. (charts.bitbo.io)

- 2021: Taproot activates; bull peaks; infra matures. (Coinbase)

- 2022: Leverage cleanse; fundamentals keep improving.

- 2023: Ordinals/inscriptions reshape fee markets and culture. (Galaxy)

- 2024: Spot ETFs unlock mainstream capital; fourth halving. (sec.gov)

- 2025: New ATHs, then a reality check—cycle behavior 101. (bytwork.com)

Actionable Bullet Points (Fast but Useful)

- Anchor to Issuance: Track the halving clock; supply will fall on schedule even if demand is noisy. (charts.bitbo.io)

- Follow Distribution Rails: ETF net inflows/outflows, exchange reserves, and custody data often front-run narrative shifts. (sec.gov)

- Respect Volatility: Plan for multi-week 20–30% drawdowns without panic; size positions to survive them. (Barron’s)

- Watch Fees & Block Space: Sustained high fees can signal new on-chain demand types (e.g., inscriptions) and miner economics. (Galaxy)

- Mind Macro: Rates, liquidity, and risk appetite still swing crypto—Bitcoin is a global macro asset now.

- Different Time Horizons: Builders (years), ETFs (quarters), traders (days) all share the same market—know which game you’re playing.

Conclusion: Same Chain, New Chapters

From 2009’s experiment to 2025’s institution-ready asset, Bitcoin has moved through distinct year-to-year phases—hype, hurt, and hardening. The protocol’s slow cadence (especially halvings) creates a drumbeat that markets dance to, while infrastructure and narratives determine how loud the music gets. In 2025 we’ve seen both sides: euphoric highs and sobering pullbacks, with the cycle’s ultimate path still determined by the tug-of-war between predictable supply and ever-changing demand. (charts.bitbo.io)

Practical Advice (Not Financial Advice)

- Build a Rules-Based Plan: Define allocation bands and rebalancing triggers ahead of time; automate contributions if your thesis is long-term.

- Use Time Diversification: Dollar-cost average and pre-decide profit-taking tiers to harvest gains during parabolic phases.

- Track Catalysts Quarterly: ETF flows, on-chain activity, fee pressure, and macro data (rates, liquidity) offer early signals. (sec.gov)

- Separate Trading from Investing: Keep a small, nimble trading bucket and a separate long-term core; don’t let one infect the other.

- Secure Your Coins: If self-custodying, practice key management; if using ETFs/custodians, understand counterparty and tracking risks.

- Expect Big Swings: Volatility isn’t a bug—it’s how a scarce asset with global price discovery equilibrates; size positions so you can sleep at night. (MarketWatch)

Meta (for SEO)

- Primary keyword: Bitcoin price history year by year

- Secondary keywords: Bitcoin halving timeline, Taproot upgrade, Bitcoin ETFs 2024, Ordinals inscriptions

- Suggested meta title: “Bitcoin’s Year-to-Year Movement (2009–2025): Halvings, ETFs, and the Road to Six Figures”

- Suggested meta description: “A relaxed, research-backed tour of Bitcoin’s price and narrative—year by year—from early halvings to 2024 spot ETFs and 2025 highs. Actionable insights and investor tips inside.”